Setting up in Saudi Arabia requires picking through complex regulation. Here’s what you need to know

Clifford Chance’s establishment of a professional partnership with Saudi Arabian firm and long-standing association partner Al-Jadaan made headlines early last year.

The move allowed Clifford Chance to formally establish its presence in the kingdom through its own legal framework, and own 75 per cent of the business.

The stability this brings the firm should not be underestimated. It could set the standard for every future launch in Saudi Arabia.

Clifford Chance is now no longer reliant on a single Saudi lawyer to sponsor it and head up its office and bank accounts. If its relationship with one of the Saudi nationals comprising the 25 per cent Saudi stake of the business disintegrates, it is no longer without a vessel for its work in the country. Instead, it can locate another suitable Saudi candidate to take the lawyer’s place. All of a sudden, the volatility that has plagued Western firms trying to establish a bridgehead in the Kingdom of Saudi Arabia (KSA) can be managed.

The new team includes two Al-Jadaan partners, banking partner Abdulaziz Al-Abduljabbar and corporate and capital markets specialist Khalid Al-Abdulkareem. Mohammed Al-Jadaan remains managing partner of Al-Jadaan and, together with the rest of the Al-Jadaan team, will now focus on litigation, mediation, strategy and structuring-focused advice. He will continue to support Clifford Chance in an advisory capacity.

Clifford Chance Riyadh managing partner Tim Plews told The Lawyer last year that he believed the firm’s professional partnership with Al-Jadaan would set a trend.

“There’s a new generation of Saudi lawyers who will try to sell this as their model,” he commented.

The Saudi legal market can be volatile, but while Clifford Chance’s solution is clearly an evolutionary step in the legal market in the kingdom, is it a feasible model for every firm and how quickly might it take root?

Furthermore, what is the best approach to setting up in the kingdom, how are firms choosing to establish themselves now, and how might this change?

This report takes into account key trends in the Saudi market and outlines why the kingdom is such a difficult place for firms to conquer.

How to secure a licence

A Clifford Chance-like structure will not necessarily suit Saudi lawyers since they will have to sign an arrangement that allows them less freedom. Currently, firms that choose not to follow Clifford Chance’s lead (or who cannot find a local lawyer who is happy with such a structure) but still want to establish themselves in Saudi need to find an association partner.

This partner must be a Saudi national. Because the law in Saudi Arabia is such a fledgling profession, the number of Saudi-born lawyers is low. The number of Saudi-born lawyers who are also suitable candidates for international firms to partner with – in other words, who have relevant experience of cross-border work – is even lower.

Rules for setting up an association require firms to be in line with local regulations. International firms must apply to the KSA Ministry of Justice to validate their association and establish a vehicle to do business in Saudi. The process of setting up an association and securing a licence is lengthy, taking anywhere from six months to a year.

Firms must also apply to the Saudi Arabia General Investment Authority (SAGIA), as does any foreign company wishing to set up in Saudi, for a foreign investment licence. The steps are numerous and involve compliance with many government departments.

Once established, the distinction between Saudi and foreign lawyers must be explicit. Firms need to be able to show what work Saudis perform and what work international lawyers do. What’s more, all front-facing work must be supervised by the Saudi associated partner, even if an international lawyer has done the bulk of it.

When setting up an association, firms have historically scouted the Saudi market for likely candidates and established relationships in a relatively straightforward way: network, relationship-build, pair off.

However, in an effort to minimise the volatility the classic association model can throw up (more of which later), firms have begun to hire Saudis as partners and then use them to establish a base. The partnership is still an association, as regulation requires, but by hiring the lawyer as a partner, firms engineer a cultural and relational shift.

One example of a firm that has taken this leap is Ashurst, which hired Faisal Adnan Baassiri in 2012 to establish its Jeddah office. Baassiri was head of legal at a private wealth management company in Jeddah before being poached by Ashurst and had done business with the firm in the region for years.

King & Wood Mallesons SJ Berwin’s (KWMSJB) recent launch was engineered by two office co-heads, one of whom, the Saudi-qualified Majed Almarshad, was hired by the Dubai office of legacy SJ Berwin in 2011. According to Almarshad, SJ Berwin had been eyeing Riyadh for years and it was the first international office the newly merged firm chose to establish.

In 2012 Allen & Overy (A&O) launched an association with Zeyad Khoshaim, made a partner in 2010, after Linklaters effectively poached A&O’s association with Abdulaziz AlGasim Law Firm, which was up for renewal after a five-year tenure. Khoshaim was formerly employed by Abdulaziz AlGasim.

These tie-ups represent a middle ground between a Clifford Chance-style professional partnership and a classic association, and the firms to establish them are among the most recent to launch a presence in Saudi Arabia. However, the practice of setting up a classic association has not disappeared, as is evident from McGuire Woods’ launch in May 2013, signing a co-operation agreement with local outfit the Law Firm of Badr Alarishi.

Arrivals: at a glance

Year formal association

established

1981 Baker & McKenzie

1989 White & Case

1996 Clifford Chance

2001 Baker Botts

2005 Norton Rose Fulbright

2006 DLA Piper

2007 King & Spalding

2007 Allen & Overy

2007 Dentons

2008 Freshfields

2009 Eversheds

2009 Hogan Lovells

2009 Clyde & Co

2010 Latham & Watkins

2011 Simmons & Simmons

2011 Jones Day

2011 Vinson & Elkins

2012 Squire Sanders

2012 Linklaters

2013 McGuire Woods

2013 Ashurst

2014 KWMSJB

It is evident from the table above that, beyond the old-timers of the 1980s and 1990s there was a significant uptick in interest in Saudi from 2006 onwards, continuing until now. This can be at least partially explained by the reign of King Abdullah, seen as a reformer, who has implemented numerous changes in policy since 2005 and has focused on foreign investment.

There is no obvious pattern that can be seen in terms of headcount or partner hires and length of time firms have been established, indicating just how unpredictable the market can be.

White & Case, Baker & McKenzie and Clifford Chance were the first firms to make a foray into the Saudi market and they remain the largest, but aside from these three, size and year of establishment do not correlate. Norton Rose Fulbright’s office has existed since 2005 but currently contains five lawyers, while Clyde & Co’s headcount is twice that number, although it was established four years later.

It is not a case of the biggest or most elite leading the crowd to Saudi. While the first Western firms to establish a presence in the region were American, from that point on, Brits took the lead until around 2010, when Latham & Watkins decided to launch in the kingdom, poaching White & Case’s sponsor Mohammed Al-Sheikh, partner Christopher Langdon and the maj-ority of the associates from White & Case’s Riyadh office.

While Latham’s wholesale poaching is among the standout relationship breakdowns in the kingdom, volatility is a huge concern more generally.

Troubled history of associations

As with any pairing, differing expectations and perspectives result in problems. An association is a naturally volatile model as the agreement relies on individuals and one common stumbling block thrown up by the pairing of a local firm with an international one is the difference in client strategy.

International firms usually come to the kingdom with a major client relationship already established. As such, they will do everything in their power to keep that client happy, and quality control and availability are paramount. For the firm’s local partner that client may be no more important than others on its roster – and may not naturally fit within its client base at all.

Corpses of former associations litter the Saudi market, with many international powerhouses running into trouble.

These disputes have come to the fore since 2012, with bickering and infighting among firms reaching a new level. Before then there were occasional instances of this, such as Latham’s takeover of White & Case’s team and DLA Piper’s rocky relationship with its partners. But as the market has become increasingly populated by Western firms, the exits and arguments have piled up.

A&O and Linklaters ran into difficulties in December 2012 when Linklaters effectively poached A&O’s association with Abdulaziz AlGasim Law Firm, which was up for renewal after a five-year tenure.

A&O responded the same month by launching a tie-up with Zeyad S Khoshaim Law Firm. Interestingly, the lead partner of its new sponsor, Khoshaim himself, joined A&O as a partner in 2010 from its ex-sponsor Abdulaziz AlGasim.

DLA Piper, although only launching a base in the kingdom in 2009, has been through the wars, chalking up three associations already. In 2006 it announced it was launching with Abdulaziz Al-Fahad, but by 2008 the relationship had broken down.

In response, DLA Piper sent in Saudi lawyer Abdulaziz Al-Bosaily, who had been a DLA partner for a year since joining from Clifford Chance, to save its practice. However, in 2009 he switched to Clyde & Co to launch its Saudi practice, where he remains, and was replaced by Eyad Reda, DLA’s current Saudi sponsor.

Other break-ups include that of Canadian firm Fasken Martineau and Herbert Smith Freehills (HSF), both of which cut their losses in KSA last year. Herbies’ split with partner firm Al-Ghazzawi Professional Association (AGP) was said to be amicable, with the firms saying their strategies had developed in different ways. HSF continues to keep “friendly ties” with AGP and is looking for other ways to maintain a presence in the market.

Fasken Martineau, however, came to blows with Osool Law, with the Canadian firm saying its clients had driven the change and the erstwhile Saudi firm saying Fasken had marketed itself outside of the arrangement.

Trowers & Hamlins, with its Middle Eastern presence still strong in Abu Dhabi, Bahrain, Dubai and Oman, closed its Jeddah office in 2011, less than a year after opening, citing low work levels. At the time it sent office head Julian Sweeting back to London, saying it would service its clients from Riyadh via its association with Feras Alshawaf Law Firm.

One year later, the firm closed that office too. UAE head Abdullah Mutawi told The Lawyer at the time that its one remaining Saudi associate had become frustrated at the firm’s failure to deploy a partner to the office and had deserted it in favour of local ally Feras Alshawaf. Trowers’ tie-up with Feras Alshawaf was dependent on it having at least one employee in the country so the alliance came to an end.

Entering a professional partnership or hiring an association lawyer as a partner are both solutions that firms have engineered in response to the volatility question. The key benefit of switching to a professional partnership system is that it gives the assurance that there is a system in place that does not rely on a particular individual.

How to work the association model

For firms that are in association models with non-partner lawyers, how to best treat the alliance so it remains fruitful is the million-riyal question. Firms need to recognise that just by signing an alliance agreement with a Saudi firm the local firm is not subsumed into its network. It is not a merger or takeover in which the bigger firm’s aims and wishes take priority. Instead, treating an association partner more like a client may be key to conquering the Saudi scene.

Firms that have succeeded in conquering the Saudi market are those that have had a lengthy presence in the kingdom and have engineered key relationships with government departments or government-owned entities such as Saudi Aramco or the Ministry of Industry.

The firms best known as possessing such relationships are the usual suspects: Saudi nationals within the legal industry commonly list A&O, Bakers, Clifford Chance and White & Case as the key Western players.

Loyalty counts for a lot in the kingdom and if a firm enters the market hoping to win big clients through networking it may be disappointed. With speculation that visa requirements will be streamlined, Western law firms’ interest in setting up in Saudi will only heighten. Newcomers will have to study others’ experiences very closely.

The independents

• Al Tamimi & Company

• Al-Fraih Law Office

• Al-Ghazzawi Professional Association

• Al-Soaib Law Firm

• Fahad Mohammed Al-Suwaiket and Bader Behaishan Al-Busaies Attorneys at Law

• Hatem Abbas Ghazzawi & Co

• Khalid Al Sunaid & Talal Al Ahmadi

• Law Offices of Dr Mujahid M Al-Sawwaf

• Osool Law Firm

• One 2 One Legal, in association with the Law Firm of Mohammed Abdulaziz Al-Aqeel

• The Law Firm of Dr Ibrahim Modaimeegh

• The Law Firm of Dr Khalid Alnowaiser

General visa guidelines

All visitors to Saudi Arabia must have a visa, except for nationals of the Gulf Cooperation Council states which include Bahrain, Kuwait, the Sultanate of Oman and the UAE.

To obtain a visa you must have a sponsor in the country. Your sponsor will be responsible for much of the required paperwork, but you will have to provide a great deal of documentation, often including marriage and birth certificates, and copies of your employment contract and academic or professional qualifications. Applicants for certain visas also require a comprehensive medical examination.

Any unaccompanied females or wives travelling to join their husbands must be met at the airport by the husband or a sponsor and have confirmed onward reservations up to their final destination in Saudi Arabia. In the case of a married couple, both spouses should carry a copy of their marriage licence whenever in public in case the mutawwa’in, or religious police, request proof of their relationship.

Although many working in Saudi Arabia choose not to bring their spouses or children for security reasons, those who wish to invite members of their family to visit or reside there must submit a request through their sponsor to the Ministry of Foreign Affairs in Saudi Arabia. If this request is approved, each family member must provide documentation as specified by the Saudi embassy.

Information provided by www.worldofexpats.com

Must-knows for arriving, from the lawyers

Longstanding relationships are key to the Saudi legal market:

“The Western firm that comes to Saudi without a business relationship of significant size runs the risk of incurring vast costs and losses. Setting up shop here in the hope of winning work through networking or local contacts may not turn out to be prudent.”

Local firms do not have the same aims and expectations as international players:

“On the one hand you have an international law firm that may say it aspires to be the world’s best practice and, for them, quality control will be a huge issue. With smaller, local firms it will be different.”

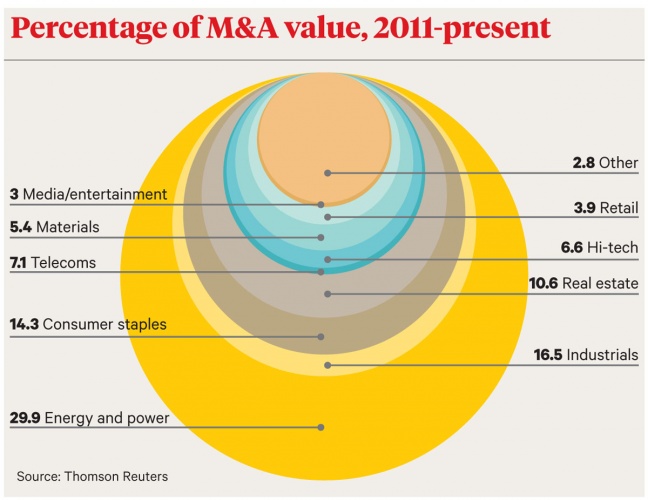

Transport and infrastructure sectors are opening up as the Saudi population increases rapidly, although the energy and petrochemicals market still dominates M&A values.

Associations are volatile as they are based on personal relationships. This volatility has increased as more international firms have entered the market:

“In the past I have been involved in an association and I can say it was a difficult thing to make work. It’s not impossible but it’s like marriage – some work and some don’t.”

M&A and infrastructure projects

• Petrochemicals and power still dominate the Saudi market, comprising 30 per cent of the past three years’ M&A activity.

• The biggest deals in 2013, and so far in 2014, were in energy and power. Sipchem’s acquisition of Sahara Petrochemicals shares topped the M&A charts in 2013 with a value of £1.5bn, with Allen & Overy and Al-Jadaan scooping adviser roles, while the top value M&A in 2014 is Aramco’s purchase of further shares in S-Oil Corp, listed as £1.2bn.

• However, even while the petrochemicals and power market dominate, the market is seeing a shift of focus, with infrastructure work coming to the fore.

• Governments in the Gulf region, and especially in Saudi Arabia, are spending hugely on infrastructure and healthcare.

• Projects include the metro systems and bus routes being constructed in Jeddah, Medina and Riyadh, and the transport sector as a whole is predicted to be active for the next six to seven years.

Changing investment priorities

The reason for the shift in priority from energy and petrochems to infrastructure and education is an increasing population, half of whom are under 25. This sector along with education and infrastructure will grow rapidly, as will healthcare as the country looks to take advantage of its oil-generated wealth, given the finite nature of the resources and the political uprisings of its neighbours.

The boom in the education sector, which has seen international clients looking to set up programmes with local Saudi education establishments, ties in with the kingdom’s historic employment – read unemployment – problem.

Of the 2 million jobs created in the country in the four years from July 2009, 1.5 million went to non-Saudis. Creating economic opportunities for Saudi nationals is of paramount importance.

The Saudi government knows it needs to build its knowledge economy. Its nitaqat policy, which expels foreign workers and fines companies that do not hire enough Saudi workers, was established in the hope of encouraging the private sector to hire Saudi nationals and not import foreign expertise.

The image promoted by the expulsion of foreign workers, which make up about a third of the country’s 30 million population, conflicts with the government’s stance on investment. Although Saudi Arabia could not be said to be an easy place to do business, foreign investment is welcome.

Indeed, since 2005 the government has reformed regulation hugely to allow for more foreign direct investment. It maintains a ‘negative’ list, prohibiting foreign companies from entering certain industries, but is hardly unique in this. Restricted industries include media, tourism and the military, but the list is vastly reduced from its previous version. There are now about nine industries closed to foreign investment, with many caveats to the bans, compared with about 30 before 2005.

Also, compared with the stance on investment taken by some members of the Gulf Cooperation Council (GCC) states (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE), the Saudi perspective on foreign investment is lenient. Some GCC nations require 51 per cent local ownership for certain investments, while in the kingdom it is possible for a company to establish 100 per cent ownership.

Outbound investment is in flux as many Saudi clients look outside the kingdom and the GCC. The country is at a stage in the economic cycle whereby its investments beyond the region is coming to the fore, whether that is in Africa, Asia, Europe or the US.

Its three biggest trading partners are China, Korea and the US, while markets that offer particularly attractive returns include western African nations, which are attracting a number of Saudi investors, particularly on sovereign-related deals, in the infrastructure and mining sectors.

The internationals (by year of arrival)

Baker & McKenzie

Year first established formal presence: 1981

Headcount: 13

Association partner: Abdulaziz Al-Ajlan & Partners

Office head: George Sayen

White & Case

Year first established formal presence: 1989

Headcount: 17

Association partner: Waleed Al-Nuwaiser

Association history: White & Case tied up with Al-Nuwaiser in 2010 following Latham & Watkins’ poaching of its former association partner, Mohammed Al-Sheikh.

Office heads: Waleed Al-Nuwaiser, several Western partners

Clifford Chance

Year first established formal presence: 1996

Headcount: 30

Association partner: Al-Jadaan

Association history: Clifford Chance was the first Western firm to establish a professional partnership in Saudi Arabia. It did so on 1 January 2014 with longstanding association partner Al-Jadaan, with which it has had one of the most stable relationships in the Saudi legal market. Prior to 1996 it worked with The Law Firm of Salah Al-Hejailan.

Office head: Tim Plews

Baker Botts

Year first established formal presence: 2001

Headcount: 7

Association partner: Mohanned bin Saud Al-Rasheed

Office head: John Lonsberg

Representative clients: Saudi Electricity Company, Saudi Investment Bank, Samba Financial Group, Riyad Bank, Banque Saudi Fransi, Emirates NBD Bank, PHI Air Medical LLC, Daikin Europe NV /Daikin McQuay Middle East FZE, PCCW, Marsh & McLennan Companies, Baxter International, Baker Hughes, ThyssenKrupp

Norton Rose Fulbright

Year first established formal presence: 2005

Headcount: 5

Association partner: Mohammed Al-Ghamdi

Association history: Norton Rose originally established an association with Abdulaziz Al-Assaf Law Firm, which ended in 2010. It had a short break from the Saudi market, servicing clients from Dubai before returning to the jurisdiction, sponsored by Al-Ghamdi.

DLA Piper

Year first established formal presence: 2006

Headcount: 8

Association partner: Eyad Reda

Association history: DLA originally launched with Abdulaziz Al-Fahad, but by 2008 relations had broken down and DLA sent in partner Abdulaziz Al-Bosaily to sponsor its practice. The next year Al-Bosaily moved to Clyde & Co, leaving DLA to again cast its net and hire Eyad Reda.

Office head: Eyad Reda

King & Spalding

Year first established formal presence: 2007

Headcount: 5

Association partner: The Law Office of Mohammad Al Ammar

Office head: Jawad I Ali

Allen & Overy

Year first established formal presence: 2007

Headcount: 13

Association partner: Zeyad Khoshaim Law Firm

Association history: A&O lost its association partner of five years, Abdulaziz AlGasim, when the firm was poached by Linklaters. A&O then tied up with Zeyad S Khoshaim Law Firm, the lead partner of which, Khoshaim, had joined A&O as a partner in 2010 from former sponsor Abdulaziz AlGasim.

Continued…

Dentons

Year first established formal presence: 2007

Headcount: 10

Association partner: The Law Firm of Wael A Alissa

Office heads: Amgad Husein, Wael Alissa

Clients: Dimension Data Group, EADS, Fresh Del Monte, GE Healthcare, Johnson & Johnson, Maximus, Oshkosh; Raytheon, Saudi Business Machines, Standard Chartered Bank, Sumitomo Corporation

Freshfields Bruckhaus Deringer

Year first established formal presence: 2008

Headcount: 7

Association partner: The Law Firm of Salah Al-Hejailan

Association history: Freshfields swapped its local associate of two years Fares Al-Hejailan for his father Salah Al-Hejailan, although Fares still works for the firm.

Office heads: Tobias Müller-Deku, Fares Al-Hejailan

Clients: Abraaj Capital, The National Shipping Company of Saudi Arabia, General Dynamics, Solvay, Gulf Investment Corporation, Samba Financial Group

Eversheds

Year first established formal presence: 2009

Headcount: 7

Association partner: Dhabaan & Partners, part of the KSLG consortium

Association history: Eversheds originally launched in Saudi in 2009 through an association with Hani Al Qurashi Law Firm. It later transferred its allegiance to KSLG, allowing it to unify its Middle Eastern presence.

Office head: Mohammed Al Dhabaan

Hogan Lovells

Year first established formal presence: 2009

Headcount: 7

Association partner: The Law Office of Montaser Al-Mohammed

Office head: Imran Mufti

Clients: Kingdom Holding, HRH Prince Alwaleed Bin Talal, King Abdullah University of Science and Technology, Saudi Hollandi Bank, Islamic Corporation for The Development of The Private Sector

Clyde & Co

Year first established formal presence: 2009

Headcount: 10

Association partner: Abdulaziz Al-Bosaily

Association history: Clydes poached DLA Piper’s office head Abdulaziz Al-Bosaily to launch in Saudi in 2009.

Clients: National Water Company, Samsung C&T, Nesma & Partners, WS Atkins & Partners, Parsons Brinckerhoff, Al Rajhi Bank, G4S, CITC, Hitachi, Toshiba, Toyota, Tata Consultancy, Acwa Power/Acwa Holding, Northern Cement Company, Wajhat Industrial Investment

Latham & Watkins

Year first established formal presence: 2010

Headcount: 7

Association partner: Salam Al-Sudari

Association history: Latham set up shop with White & Case former association partner Mohammed Al-Sheikh along with other former members of White & Case’s Riyadh office. Al-Sheik left in 2012 as he was elected as the executive